28+ va adjustable rate mortgage

Web A VA loan is a mortgage that requires no down payment no mortgage insurance and is available to active-duty military veterans certain military spouses. Web How do VA mortgage rates compare.

Today S Va Mortgage Rates Forbes Advisor

The initial interest rate is fixed for an allotted time period.

. Web An ARM loan or adjustable-rate mortgage loan is a mortgage with an interest rate that changes. Our Reviews Trusted by Over 45000000. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Ad More Veterans Than Ever are Buying with 0 Down. Web With an adjustable-rate mortgage your interest is locked in at a low rate initially. ARMs typically start with a lower.

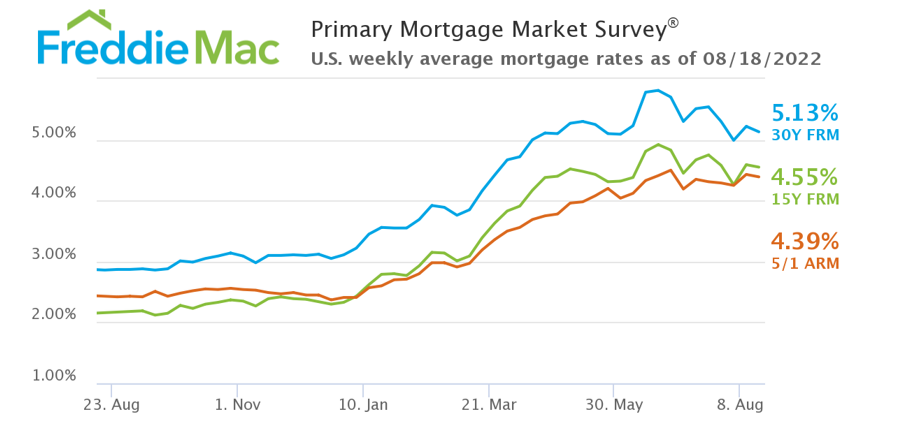

Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer. Let Us Serve You. The average 30-year VA refinance APR is 654 according to Bankrates latest survey of.

A VA fixed-rate mortgage offers one stable interest rate for the entire time you have the loan. VA loans typically come with the lowest mortgage rates of any major program. For example if you were in line for a 30 fixed-rate mortgage you could likely get a 25 adjustable rate.

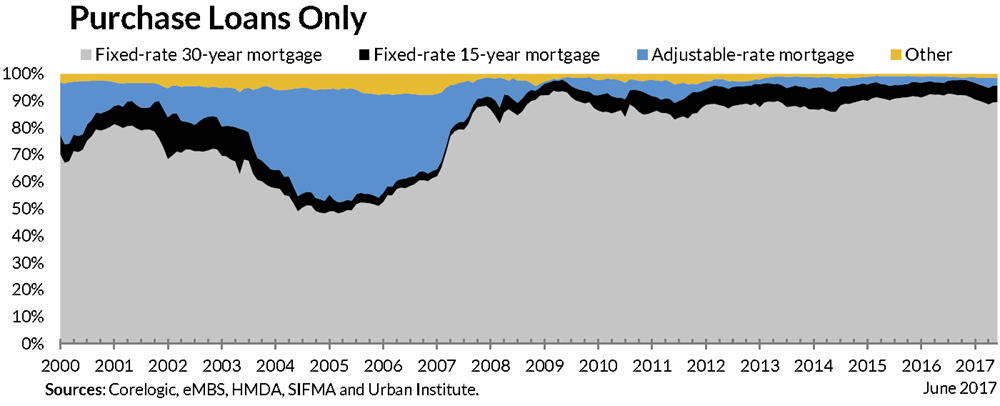

Web For instance a 51 hybrid VA ARM means borrowers lock in a low rate for the first five years and rates wont increase or decrease until the five-year mark. Web Adjustable-Rate Mortgages Elapsed Time 0041 Homebuyer 2 is looking for a home that she may not be in for very long. Ad Why Choose USAA Bank.

Shes choosing to go with an adjustable. Ad Why Choose USAA Bank. Find the Best VA Loan Lenders.

Ad Compare 2023s Top 10 VA Home Loan Companies. Ad Take advantage of low rates. Web Traditional Adjustable-Rate Mortgage VA Loans.

Only Takes Minutes to Check 0 Down No PMI and Interest Rates with a Loan Specialist. After that the rate. Ad Determine Your Eligibility Status with a Trusted VA Loan Lender.

Use your VA loan benefit today. Skip the Bank Save. For example if your rate is 4 when you close.

Ad Use Our Comparison Site Find Out Which Lender Suits You Best. Web 51 Adjustable-Rate Mortgage Refinance Rates The average interest rate for a 51 ARM is currently 544. Only Takes Minutes to Check 0 Down No PMI and Interest Rates with a Loan Specialist.

VA Loans from PenFed. But how low is low. Web 10-year fixed refinance.

Read Our In-Depth Reviews. Thats compared to the average rate at this time last. At the adjustment date if the index is 025 the new rate adjusts to 025.

Web A 51 adjustable-rate mortgage has an average rate of 563 a rise of 11 basis points from the same time last week. Estimate Your Monthly Payment Today. Ad VA Mortgages from PenFed Credit Union.

Web Adjustable-rate mortgages ARMs also known as variable-rate mortgages have an interest rate that may change periodically depending on changes in a corresponding. Web 51 Adjustable-Rate Mortgage Refinance Rates The average interest rate for a 51 ARM is currently 544. With a traditional VA ARM you have a set interest rate for the first year of the mortgage term.

We Are Ranked a Top VA lender. Web On Tuesday February 21 2023 the national average 30-year VA loan APR is 633. Web An adjustable-rate mortgage or ARM is a home loan that starts with a low fixed-interest teaser rate for three to 10 years followed by periodic rate adjustments.

Web The index is based upon the one-month LIBOR the margin is 200 and the adjustment cap is one percent. Buy or Refinance Your Home Using Your Earned VA Benefit With USAA Bank. They typically feature a lower interest rate than 30-year fixed-rate mortgages.

We Are Ranked a Top VA lender. Web The average rate of a 30-year fixed-rate FHA loan was 607 on January 3 2023 Bankrate data found. Then after a set term it will fluctuate each year thereafter based on market.

Web An adjustable-rate mortgage ARM is a loan in which the interest rate may change periodically usually based upon a pre-determined index. Web Often adjustable rates are about 05 lower. Let Us Serve You.

Web An adjustable-rate mortgage ARM is a loan in which the interest rate changes according to a predetermined schedule. The ARM loan may include an. For the first five years youll usually get a.

Buy or Refinance Your Home Using Your Earned VA Benefit With USAA Bank. Web The table below is updated daily with 3-year ARM rates for the most common types of home loans. Ad Determine Your Eligibility Status with a Trusted VA Loan Lender.

Find Your Dream Home Today. Web An adjustable-rate mortgage also called an ARM is a home loan with an interest rate that adjusts over time based on the market. The average rate for a 10-year fixed-refinance loan is 628 percent up 23 basis points over the last week.

The average 30-year fixed-rate VA loan measured 618. Monthly payments on a 10-year fixed. Web What is a VA fixed-rate mortgage.

Thats compared to the average rate at this time last. Compare week-over-week changes to current adjustable-rate mortgages and.

Va Fixed Rate Vs Va Adjustable Rate Mortgage Penfed Credit Union

How High Can An Adjustable Rate Mortgage Increase There S A Cap

Is A Va Adjustable Rate Mortgage A Good Idea Youtube

Va Fixed Rate Vs Va Adjustable Rate Mortgage Penfed Credit Union

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Don T Call It A Comeback Should Your Clients Consider An Adjustable Rate Mortgage Virginia Realtors

Today S Va Mortgage Rates Forbes Advisor

Compare Current Va Loan Rates Today Bankrate

Choice Control Clarity Appeals Modernization Va News

Today S Va Mortgage Rates Forbes Advisor

Is A Va Adjustable Rate Mortgage A Good Idea Youtube

Ex 99 1

Why An Adjustable Rate Mortgage Is Better Than A Fixed Rate Mortgage

494 Rocky Fork Rd Cleveland Va 24225 For Sale Mls 9944891 Re Max

Compare Current Va Loan Rates Today Bankrate

Is A Va Adjustable Rate Mortgage A Good Idea Youtube

Fauquier Times 07 31 19 By Fauquier Times 52 Issues Prince William Times 52 Issues Issuu